Related Links

spotlight

Thomas Murray Data Services Upgrades the Central Securities Depository Rating for Nigeria’s Central Securities Clearing System (CSCS) from A- to A, with a Positive Outlook

L-R:

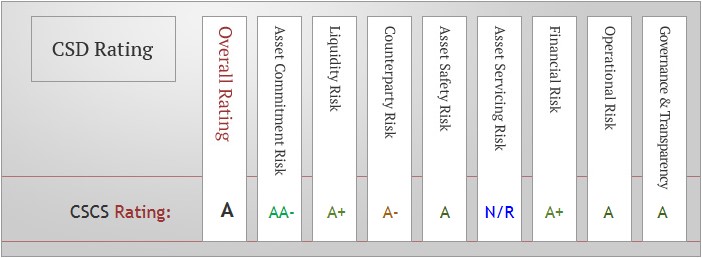

LONDON – Thomas Murray Data Services, the specialist custody rating, risk management and research firm, has upgraded the CSD rating for Nigeria’s Central Securities Clearing System (CSCS) from A- to A, which denotes as ‘Low Overall Risk’. The overall rating is made up of the following components:

The Overall Rating of ‘A’ reflects a weighted average of seven risk components. The rating for Asset Servicing Risk has been omitted from the Overall Risk Rating since CSCS takes no active part in the entitlement calculation or processing of corporate actions in the market. Three risk components have been upgraded:

• Asset Commitment Risk from A to AA-, based on the shifting of settlement value ratio in favour of OTC bond transactions which overall have a shorter asset commitment period than on-exchange transactions.

• Operational Risk from A- to A, reflecting improvements in internal controls, operational procedures and business continuity planning and disaster recovery procedures.

• Governance and Transparency (G&T) Risk from A- to A, on account of better disclosure of corporate and statistical information on CSCS’s website, and improved performance management standards and user group arrangements.

Other major developments which have contributed to reducing settlement risks in the market include the new SEC minimum capital requirement for brokers/dealers (NGN 300 million, approx. USD 1.5 million) and the shifting of cash settlement for on-exchange transactions from the afternoon to the morning of settlement date (SD). The new capital requirement, (increased from NGN 70 million), reduces counterparty risk exposures in the market; however it is not sufficient to warrant a Counterparty Risk rating upgrade. Cash settlement at the Central Bank of Nigeria (CBN), for on-exchange transactions, now occurs around 9.00am SD (changed from 3.00pm SD), which is about an hour after securities settlement at CSCS. This move has reduced the asset commitment period for sales, but there is still no interdependence of the cash leg and securities leg settlement, i.e. no delivery versus payment (DVP) settlement.

The outlook of CSCS rating is ‘Positive’ owing to developments taking place in the course of 2016-17, with a positive impact on Counterparty Risk, Asset Safety Risk, Operational Risk and Financial Risk. These developments include:

• CSCS becoming a member of the RTGS system (pending approval of the CBN), which will allow CSCS to settle transactions on a DVP basis by linking the securities leg and cash leg of settlement.

• Implementation of new clearing and settlement system (TCS BaNCS) with SWIFT integration scheduled for Q1 2017 will improve CSCS operational efficiency and level of straight-through processing in the market. In addition, the new system is expected to improve the reconciliation process between CSCS, market participants, with a positive impact on Asset Safety risk.

• CSCS Draft Amended Rules are awaiting SEC approval. Amended Rules clearly state CSCS liability for losses incurred by participants, and the maximum amount payable by CSCS which is the amount recovered from the insurers and responsible persons. Once in place, this will dissipate ambiguities around CSCS liability and potential claims on CSCS financial resources.

Nick Bradley, Chief Risk & Ratings Officer of Thomas Murray Data Services said: “The overall rating upgrade acknowledges actions taken by CSCS over the past few years to mitigate risks. This is the result of CSCS’s continuous efforts toward adopting international best practices.”

Kyari Abba Bukar, Managing Director and CEO of CSCS Plc said: “The upgrade from A- to A is a significant milestone towards being a globally respected and leading central securities depository in Africa. The key upgraded areas further indicate that we made notable improvements in managing our market’s overall risks to low level in line with best practices. I am glad that the efforts made in this regard over the years is of significant impact due to the collective effort of all our committed staff.”

The CSD rating assesses the risk exposures for investors associated with the processes the CSD has in place to facilitate the safekeeping and the clearing and settlement of securities, where applicable. It assesses eight key risks (rating components). The methodology considers the capabilities of the depository and the quality and effectiveness of its operational infrastructure. It also assesses the depository’s willingness and ability to protect its participants or clients from losses. As part of the rating, the scope and quality of the depository’s services is assessed. The ratings are on a consistent global scale, using the familiar AAA to C ratings scale. Once the rating is assigned there is an ongoing surveillance process to monitor the depository.

Thomas Murray Data Services maintains proprietary assessments of over 130 CSDs globally as part of the Thomas Murray Depository Risk Assessment services. These reports are available via the Thomas Murray on-line store at ds.thomasmurray.com

| For further information contact: | |

|

Jim Micklethwaite Capital Markets Thomas Murray Data Services +44 (0) 208-600-2300 jmicklethwaite@ds.thomasmurray.com |

Ayokunle Adaralegbe Chief Risk Officer Central Securities Clearing System Plc +234 (1) 903 3555 adaralegbe.ayokunle@cscsnigeriaplc.com |

About Thomas Murray Data Services

Thomas Murray Data Services is a specialist custody rating, risk management and research firm specialising in the global securities services industry. Thomas Murray was established in 1994. The Company monitors and analyses over 250 custodians globally and evaluates the risk of around 90 capital market infrastructures. The company has a strong position as a provider of public and private ratings and risk assessments on global custodians, domestic custodian banks and capital market infrastructures.

About Central Securities Clearing System (CSCS)

Central Securities Clearing System Plc commenced operations on 14 April 1997, and operates a computerised depository, clearing, settlement system for transactions in securities in the Nigerian Capital Market.

CSCS settles transactions executed on both the Nigerian Stock Exchange (NSE) and OTC platforms (NASD and FMDQ). In addition, CSCS assigns International Securities Identification Number (ISIN), Legal Entity Identifier (LEI) number, Domestic Symbol codes, Classification of Financial Instruments (CFI) codes and Financial Instruments Short Name (FISN) codes for eligible securities, and issues Central Clearing House Number (CHN) to facilitate investors’ identification.